Mashreq Delivers Strong 9M 2025 Performance with Operating Income of AED 9.4 Billion and 8% Year-on-Year Growth in Q3; Total Assets Surpassing AED 300 Billion.

Dubai, UAE: Mashreq reported its financial results for 9M 2025. Mashreq reported an increase in Operating Income to AED 9.4 billion for the 9M 2025. The third quarter Operating Income of AED 3.2 billion, is an increase of 4% Quarter-on-Quarter and 8% Year-on-Year, reflecting strong profitable growth across all its core businesses, mainly driven by rising client activity, resilient Net Interest Income and high non-interest income growth (20% Year-on-Year). Net Profit Before Tax of AED 6.1 billion, underscoring the Bank’s ability to continue to deliver strong profitability amid a moderating rate environment, supported by a Net Interest Margin of 3.2%, a Cost-to-Income Ratio of 31%, and a Return on Equity of 20%. Total Assets surpassed AED 300 billion for the first time, with continued double-digit balance-sheet expansion and the depth of Mashreq’s franchise. Customer Loans & Advances increased by 21% Year-on-Year and customer deposits by 20% Year-on-Year. Mashreq continues to advance its strategy by combining balanced growth with efficiency, accelerating investment in digital platforms and data intelligence, and expanding its global presence to create enduring value for clients and shareholders.Key Highlights:

- Revenues and Income Generation

Operating income growth led by expanding lending activity, deeper client engagement, and stronger non-interest income across Mashreq’s global businesses.

- Operating income increased to AED 9.4 billion in 9M 2025, a result of broad-based commercial strength across corporate and retail, as well as the various international segments. Growth in loans and advances and customers deposits remain key drivers, complemented by rising client activity and a strong contribution from non-interest income, demonstrating Mashreq’s ability to convert business momentum into strong topline growth and diversified earnings amid an easing rate environment.

- Net interest income rose 6% quarter-on-quarter to AED 2.1 billion in Q3 2025, with a stable Net Interest Margin of 3.2% for 9M 2025. Loan growth, disciplined asset repricing, and a strong funding base, with Current Account Savings Account (CASA) at 66% of deposits, continued to offset rate-driven margin pressure and preserve spread stability.

- Non-interest income increased 20% year-on-year, driven by a 50% rise in Investment Income and a 41% increase in Other Income, reflecting stronger client activity, market opportunities captured across investment and trading portfolios, and ongoing diversification of Mashreq’s revenue base.

- Growth in non-interest income led to a near 5% year-on-year improvement in the Cross-Sell Ratio to 35%, highlighting deepening client relationships and more balanced earnings mix across businesses.

- Expenses and Efficiency

Strategic investments in digital platforms, AI capabilities, and international expansion managed through disciplined cost control to maintain Mashreq’s industry-leading efficiency and operational scalability.

- Mashreq continued to drive investments toward digital transformation, AI-led innovation, and international expansion, reinforcing the Bank’s long-term competitiveness and scalability while maintaining one of the most efficient cost structures.

- Cost-to-Income Ratio remained industry-leading at 31%, underscoring Mashreq’s ability to pursue growth and modernization while preserving strict cost discipline through automation, process streamlining, and technology-led operating leverage.

- Spending remained tightly focused on high-impact initiatives including next-generation digital ecosystems, AI-driven operational platforms, and expansion across Türkiye, Oman, Pakistan and India’s GIFT City.

- Mashreq’s operating model continues to drive scale and efficiency, enabling the Bank to invest confidently in transformation and international growth while sustaining benchmark levels of productivity and cost efficiency.

- Earnings and Profitability

Profit strength supported by diversified income streams, disciplined balance-sheet management, and prudent risk controls despite a softer rate environment and higher taxation.

- Mashreq delivered Net Profit Before Tax of AED 6.1 billion and Net Profit After Tax of AED 5.2 billion in 9M 2025, marking another strong earnings performance driven by diversified income growth, disciplined balance-sheet management, and consistent operational excellence across the franchise.

- Strong Return on Equity stood at 20% and Return on Assets at 2.3%, reflecting Mashreq’s consistent ability to generate solid returns through disciplined execution, efficient capital deployment, and an enhanced operating model.

- Tax expense rose 49% year-on-year to AED 961 million following the UAE’s adoption of the corporate income tax regime and the introduction of Global Minimal Tax in most countries Mashreq operates in; nevertheless, profitability remained firm, supported by strong underlying income and sustained cost efficiency.

- Impairment charges were contained at AED 366 million (cost of credit 34 bps), underscoring Mashreq’s high asset quality, conservative provisioning, and prudent risk management practices that continue to safeguard earning stability.

- Asset Quality and Risk Management

Industry-leading asset quality supported by rigorous credit governance, forward-looking risk management, and conservative provisioning, reflected in high coverage ratios and continued credit strength.

- Mashreq continues to maintain one of the lowest levels of non-performing loans (NPLs), with the NPL ratio standing at 1.1% as of September 30, 2025 (down from 1.5% September 30, 2024), reflecting disciplined underwriting, prudent exposure management, and sustained portfolio quality across businesses and geographies.

- Coverage ratio stood at 235%, highlighting Mashreq’s conservative provisioning approach and strong capacity to absorb potential credit losses while maintaining the flexibility to support future growth.

- Credit quality remained strong across all segments, driven by rigorous risk management practices, sound collateral structures, and a well-diversified loan book that continues to perform strongly under a moderating rate environment.

- Mashreq’s disciplined credit governance and conservative risk governance framework continue to reinforce balance-sheet resilience and stakeholder confidence, positioning the Bank to sustain growth while preserving superior asset quality through cycles.

- Balance Sheet Strength

Balance-sheet surpasses AED 300 billion, reflecting deep client franchise strength, disciplined lending expansion, and a well-diversified funding base across core markets.

- Total assets crossed for the first time AED 300 billion, up 20% year-on-year and 14% year-to-date to AED 305 billion as of September 30, 2025, supported by strong lending activity, expanding client relationships, and a growing contribution from international markets.

- Total lending across customers and banks grew 24% year-on-year to AED 208 billion, with credit expansion concentrated in strategically important sectors such as trade, manufacturing, and infrastructure, aligning with national development priorities and Mashreq’s balanced, risk-calibrated growth strategy.

- Customer deposits reached AED 187 billion, demonstrating Mashreq’s strong funding franchise and ability to attract stable deposits through enhanced transaction flows and product innovation. The high CASA Ratio of 66% continues to anchor a stable, low-cost funding base that supports both profitability and liquidity strength.

- Mashreq’s balance sheet now embodies scale, diversification, and prudent execution. The Bank remains well-positioned to leverage its capital strength and funding access to support clients across expanding regional and international corridors.

- Capital and Liquidity Position

Strong capital and liquidity foundations offering comfortable buffers above regulatory thresholds, supported by sustained profitability and a conservative balance-sheet approach.

- Mashreq maintained an industry leading liquidity position, with a Liquid Assets Ratio of 27%, a Loan-to-Deposit Ratio of 76%, and a Liquidity Coverage Ratio (LCR) of 123%; all comfortably above regulatory requirements. These metrics reflect the Bank’s measured funding strategy, stable deposit base, and prudent management of liquidity risk

- Capitalization remained among the strongest in the sector, with a Capital Adequacy Ratio (CAR) of 16.8%, a Tier 1 Capital Ratio of 15.5% and a Common Equity Tier 1 (CET1) Ratio of 14.2%. The strength of Mashreq’s capital base continues to be underpinned by solid internal capital generation, stable asset quality, and conservative risk governance, ensuring sufficient capacity to fund growth and comfortably meet regulatory expectations.

| AED 6.1 billion Net Profit Before Tax |

AED 9.4 billion Revenue |

AED 6.5 billion Operating Profit |

|||

| 21% YoY Loans & Advances Growth |

20% YoY Customer Deposits Growth (CASA 66%) |

31% Cost to Income Ratio |

|||

| 20% Return on Equity |

2.3% Return on Assets |

3.2% Net Interest Margin |

|||

| 17% Capital Adequacy Ratio |

1.1% NPL to Gross Loans Ratio |

235% NPL Coverage Ratio |

|||

H.E. Abdul Aziz Al Ghurair

Chairman, Mashreq

“Mashreq’s performance stands as a testament to the strength of our strategic vision and the trust we continue to earn from clients, shareholders, and partners. Surpassing AED 300 billion in total assets is a clear reflection of our disciplined growth strategy and our deep alignment with the evolving economic priorities of the markets in which we operate. This achievement comes at a time when the UAE’s banking sector is demonstrating exceptional resilience and dynamism. Backed by strong capital and liquidity positions, improved asset quality, and steady growth across key indicators, the financial system remains well-positioned to support economic expansion.

Looking ahead, we expect the banking sector’s outlook to remain positive, supported by sound fiscal governance, robust fundamentals, and the continued advancement of a transparent and innovation-led financial ecosystem. As we continue building on this momentum, Mashreq remains firmly committed to enabling sustainable, inclusive growth, both in our home market and across the international communities we serve.”

H.E. Abdul Aziz Al Ghurair

Chairman, Mashreq

“Mashreq’s performance stands as a testament to the strength of our strategic vision and the trust we continue to earn from clients, shareholders, and partners. Surpassing AED 300 billion in total assets is a clear reflection of our disciplined growth strategy and our deep alignment with the evolving economic priorities of the markets in which we operate. This achievement comes at a time when the UAE’s banking sector is demonstrating exceptional resilience and dynamism. Backed by strong capital and liquidity positions, improved asset quality, and steady growth across key indicators, the financial system remains well-positioned to support economic expansion.

Looking ahead, we expect the banking sector’s outlook to remain positive, supported by sound fiscal governance, robust fundamentals, and the continued advancement of a transparent and innovation-led financial ecosystem. As we continue building on this momentum, Mashreq remains firmly committed to enabling sustainable, inclusive growth, both in our home market and across the international communities we serve.”

Ahmed Abdelaal

Group Chief Executive Officer, Mashreq

Mashreq continues to deliver strong and sustainable performance underpinned by a clear strategic vision and a disciplined operating model. Our net profit reached AED 6.1 billion, supported by a 20% year-on-year increase in non-interest income and AED 9.4 billion in operating income, reflecting broad based growth across corporate, retail, and international segments.

One of the most significant developments this year has been our commercial launch in Pakistan, a milestone that reinforces our international strategy. We have received strong support from government, regulators and stakeholders, and the market’s positive reception has validated our digital first approach to serving both individuals and businesses in one of the most promising economies in the region.

Our growing presence across key international markets is enabling us to support the flow of capital and commerce along vital global trade corridors connecting Asia, the Middle East, Europe, and the United States. This includes our expansion into GIFT City in India, a pivotal step in advancing the India–Middle East corridor and strengthening our ability to provide seamless cross-border financial solutions and capitalize on the immense potential of this corridor.

As trade volumes continue to expand, Mashreq is well positioned to play a pivotal role in facilitating cross-border financial activity and enabling regional growth. At the same time, we are embedding advanced digital and AI technologies across our operations to enhance the way we serve clients and manage risk. These innovations are central to our strategy, helping us unlock new efficiencies, deliver more intuitive experiences, and scale impact across every business line.

We remain focused on building a future-ready banking ecosystem that delivers lasting value to our clients, shareholders, and communities. With strong capital, diversified growth drivers, and a clear international agenda, Mashreq is exceptionally well placed to capture new opportunities and shape the future of financial services in the region and beyond.

Looking Ahead

Building on the solid progress achieved throughout 2025, Mashreq will continue advancing its long-term strategic agenda centered on scalability, innovation, and intentional international growth. The Bank remains focused on embedding advanced digital and AI capabilities across its businesses to enhance client experience, strengthen risk management, and drive operational efficiency.

Over the coming quarters, Mashreq will deepen its international presence across Türkiye, Oman, Pakistan, and India’s GIFT City, while further broadening its access to global funding and capital markets. These initiatives are designed to reinforce Mashreq’s position as a regionally anchored, globally connected financial institution with a diversified growth engine.

Supported by a strong capital base, robust liquidity, and industry-leading asset quality, Mashreq is well positioned to sustain profitable growth, deliver consistent returns, and continue creating long-term value for clients, shareholders, and stakeholders.

Ahmed Abdelaal

Group Chief Executive Officer, Mashreq

Mashreq continues to deliver strong and sustainable performance underpinned by a clear strategic vision and a disciplined operating model. Our net profit reached AED 6.1 billion, supported by a 20% year-on-year increase in non-interest income and AED 9.4 billion in operating income, reflecting broad based growth across corporate, retail, and international segments.

One of the most significant developments this year has been our commercial launch in Pakistan, a milestone that reinforces our international strategy. We have received strong support from government, regulators and stakeholders, and the market’s positive reception has validated our digital first approach to serving both individuals and businesses in one of the most promising economies in the region.

Our growing presence across key international markets is enabling us to support the flow of capital and commerce along vital global trade corridors connecting Asia, the Middle East, Europe, and the United States. This includes our expansion into GIFT City in India, a pivotal step in advancing the India–Middle East corridor and strengthening our ability to provide seamless cross-border financial solutions and capitalize on the immense potential of this corridor.

As trade volumes continue to expand, Mashreq is well positioned to play a pivotal role in facilitating cross-border financial activity and enabling regional growth. At the same time, we are embedding advanced digital and AI technologies across our operations to enhance the way we serve clients and manage risk. These innovations are central to our strategy, helping us unlock new efficiencies, deliver more intuitive experiences, and scale impact across every business line.

We remain focused on building a future-ready banking ecosystem that delivers lasting value to our clients, shareholders, and communities. With strong capital, diversified growth drivers, and a clear international agenda, Mashreq is exceptionally well placed to capture new opportunities and shape the future of financial services in the region and beyond.

Looking Ahead

Building on the solid progress achieved throughout 2025, Mashreq will continue advancing its long-term strategic agenda centered on scalability, innovation, and intentional international growth. The Bank remains focused on embedding advanced digital and AI capabilities across its businesses to enhance client experience, strengthen risk management, and drive operational efficiency.

Over the coming quarters, Mashreq will deepen its international presence across Türkiye, Oman, Pakistan, and India’s GIFT City, while further broadening its access to global funding and capital markets. These initiatives are designed to reinforce Mashreq’s position as a regionally anchored, globally connected financial institution with a diversified growth engine.

Supported by a strong capital base, robust liquidity, and industry-leading asset quality, Mashreq is well positioned to sustain profitable growth, deliver consistent returns, and continue creating long-term value for clients, shareholders, and stakeholders.

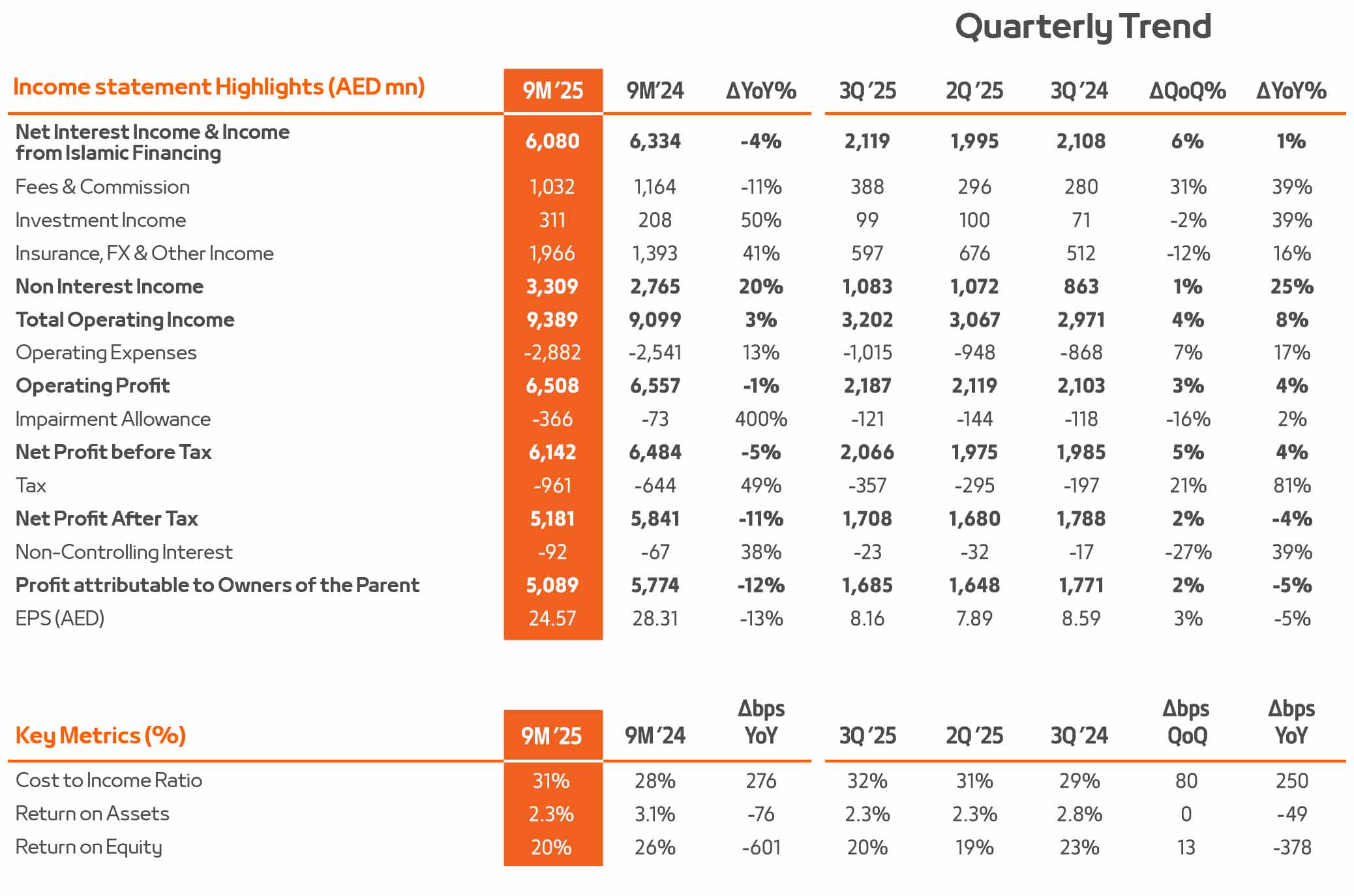

Financial Performance Overview:

Note: Figures may not add up due to rounding differences

Note: Figures may not add up due to rounding differences

- Net Interest Income rose 6% quarter-on-quarter in Q3 2025 supported by double digit credit and investments growth resulting in stable NIM of 3.2% in 9M 2025.

- Non-Interest Income rose 20% year-on-year in 9M 2025 to AED 3.3 billion driven by strong Investment Income growth which is up 50% year-on-year and Other Income which is up 41% year-on-year and contributed 35% of Total Operating Income.

- Continued double digit expansion in loans and advances and non-interest income resulted in 3% year-on-year increase in Total Operating Income to AED 9.4 billion in 9M 2025.

- Operating expenses grew by 13% year-on-year in 9M 2025, with continued investments in digital innovation, automation, Gen-AI led initiatives and strategic business expansion.

- Impairment allowances remained low with double digit loan and advance growth at AED 366 million in 9M 2025 (cost of credit of 34bps) underlining strong asset quality and robust macroeconomic backdrop in key UAE market.

- Income tax expense of AED 961 million in 9M 2025 up by 49% year-on-year impacted the net profit after tax, which saw a decline of 11% to reach AED 5.2 billion in 9M 2025, with a strong ROE of 20%.

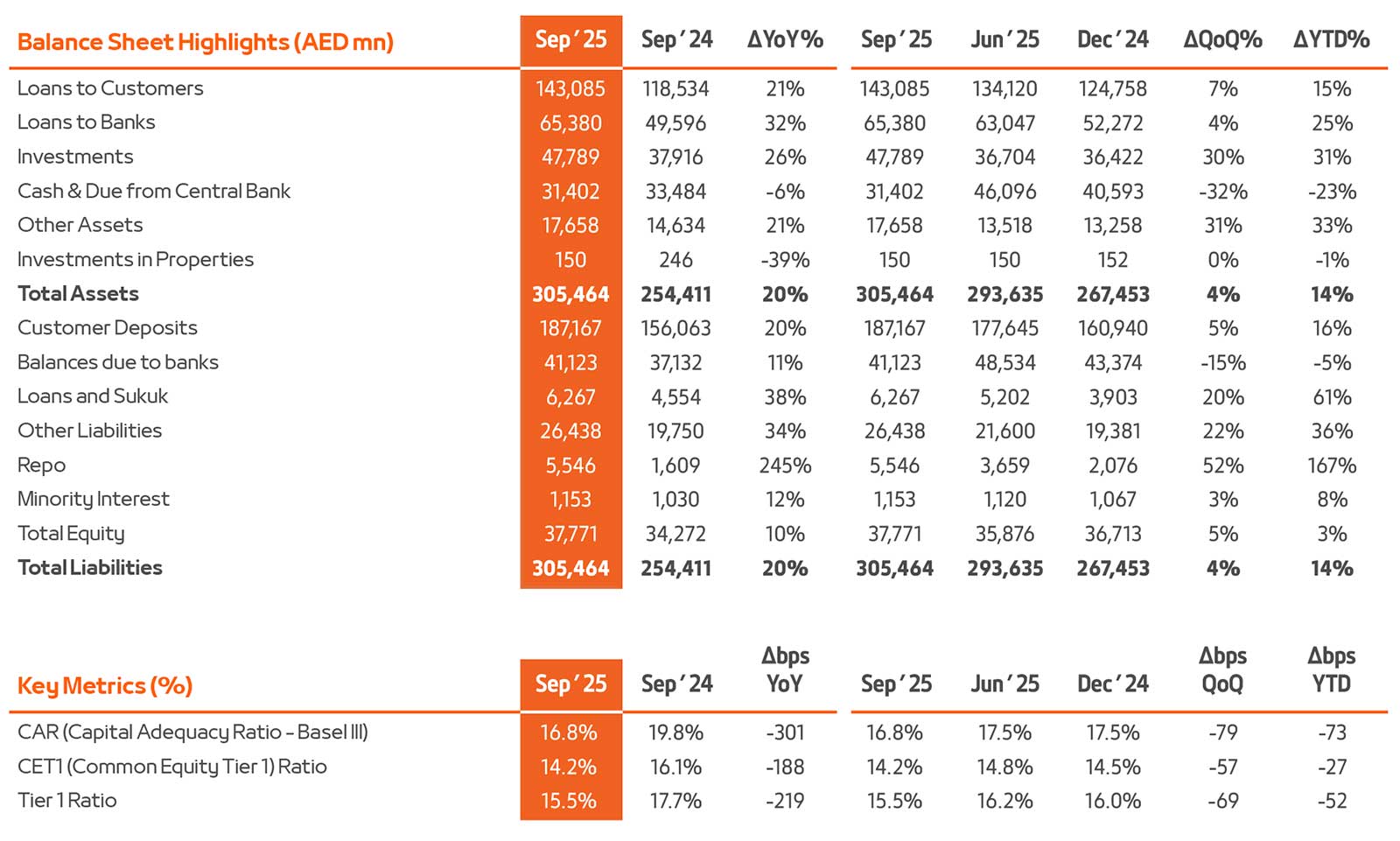

Note: Figures may not add up due to rounding differences

Note: Figures may not add up due to rounding differences

- Total Assets increased 20% year-on-year and 14% year-to-date to reach AED 305 billion, driven by continued credit growth and expansion of investment portfolio.

- The growth in the balance sheet is supported by year-on-year growth in total assets of wholesale banking segment by 25% year-on-year to AED 171 billion and retail banking segment by 10% year-on-year to AED 35 billion.

- Customer Deposits increased 20% year-on-year and 16% year-to-date to reach AED 187 billion maintaining a healthy funding mix with 20% year-on-year growth in CASA, with CASA mix of 66%.

- NPL Ratio reached historical low of 1.1%, the lowest in industry.

- Despite double digital credit and investment growth resulting in increased risk weighted assets, the capitalization remained strong in 9M 2025. Capital Adequacy Ratio of 16.8%, CET1 ratio of 14.2% and Tier 1 ratio of 15.5%, remained well above the regulatory requirement.

Awards:

Click HereUAE

Financials