Dubai, UAE: Mashreq Bank PSC (MASQ) reported its financial results for H1 2025.

Mashreq’s operating income reached AED 6.2 billion in H1 2025, reaffirming the Bank’s position as one of the region’s most resilient and forward-looking financial institutions.

The performance reflects Mashreq’s continued ability to generate strong, broad-based growth despite a softening interest rate environment, supported by double-digit increases in both lending and non-interest income. Return on Equity remained robust at 20%, while the industry-leading Cost-to-Income ratio of 30% highlights ongoing efficiency even amid accelerated investment in digital transformation, AI-enabled capabilities, and strategic international market expansion. These results underscore Mashreq’s disciplined execution, diversified revenue model, and long-term focus on sustainable value creation for clients and shareholders alike.

Key Highlights:

- Revenues

Robust topline performance underpinned by diversified growth, pricing discipline and a superior funding mix.

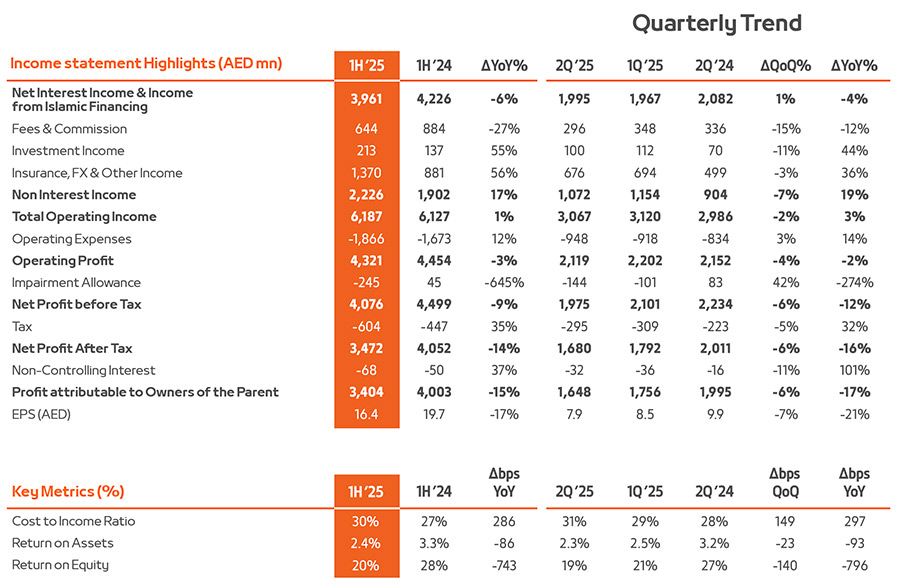

- Operating income rose to AED 6.2 billion in H1 2025, driven by 21% year-on-year growth in loans and robust contributions from investment and other non-interest income streams—highlighting Mashreq’s ability to capture value across cycles and deliver quality growth amid moderating interest rates.

- Net interest income increased 1% quarter-on-quarter to AED 2.0 billion in Q2 2025, as sustained volume growth and disciplined asset repricing offset the cumulative 100bps rate cut implemented since 2024. Net Interest Margin (NIM) remained strong at 3.2%, supported by continued enhancement of Mashreq’s funding profile, with the CASA ratio improving to a market-leading 69%, up from 62% year-on-year.

- Non-interest income expanded 17% year-on-year, propelled by a 55% surge in investment income and a 56% increase in other income streams. The Cross-Sell Ratio rose to 36%, a 5% year-on-year improvement, reinforcing the strength of Mashreq’s relationship-led strategy and deepening client penetration across businesses.

- Net Profit

Resilient bottom-line delivery driven by core strength, global expansion, and capital efficiency—despite higher tax headwinds.

- Profit Before Tax reached AED 4.1 billion in H1 2025, underscoring the continued strength of Mashreq’s core banking franchise and the momentum across key business lines. This performance was achieved despite a softer rate environment, normalization of risk costs, and sustained strategic investments in digital innovation and international expansion across Türkiye, Oman, and Pakistan.

- Net Profit After Tax stood at AED 3.5 billion, reflecting Mashreq’s ability to deliver solid earnings and maintain profitability in the face of a significantly higher tax burden following the implementation of the UAE’s 15% global minimum tax under the Pillar Two framework.

- Return on Equity (ROE) remained strong at 20%, illustrating the Bank’s ongoing ability to generate superior shareholder returns through disciplined capital allocation, a capital-light operating model, and diversified revenue streams.

- Mashreq’s earnings profile remains balanced and resilient, demonstrating its capacity to sustain profitability while continuing to invest in long-term growth across digital platforms, strategic markets, and client-centric verticals.

- Expenses

Strategic investment in digital transformation, global talent, and international client platforms—delivered with best-in-class cost efficiency.

- Operating expenses increased by 11.5% year-on-year, reflecting focused investments to support Mashreq’s international expansion, upgrade digital infrastructure, and enhance client interface channels across all key markets. This includes continued advancement of next-generation platforms, automation, and GenAI-led initiatives, as well as targeted recruitment and upskilling of high-impact talent.

- Despite elevated investment activity, the cost-to-income ratio remained best-in-class at 30%, underscoring Mashreq’s operational discipline, scalable technology backbone, and sustained ability to drive efficiency while executing its strategic growth roadmap.

- Asset Quality

Exceptional credit discipline and proactive risk management sustain sector-leading asset quality.

- Provision charges increased to AED 245 million in H1 2025, reflecting Mashreq’s prudent and forward-looking risk posture in light of continued global macroeconomic and geopolitical uncertainties, despite robust double-digit loan growth.

- The Non-Performing Loan (NPL) ratio further improved to 1.2%, down from 1.3% year-on-year, reaffirming Mashreq’s market-leading asset quality and underscoring the effectiveness of its disciplined underwriting and early-warning risk frameworks.

- The Coverage Ratio remained exceptionally strong at 210%, highlighting the Bank’s conservative provisioning strategy and its strong capacity to absorb potential credit stress, even under evolving operating conditions.

- Balance Sheet

Sustained double-digit growth anchored in strong client demand (loans up 21%), funding depth (CASA 69%), and strategic lending across key sectors.

- Mashreq’s balance sheet expanded by 16% year-on-year in H1 2025, reflecting healthy underlying demand across priority markets and continued momentum in both wholesale and retail banking segments.

- Loans and advances—including to customers and banks—grew by a solid 21% year-on-year, with growth concentrated in strategically important sectors such as residential mortgages, manufacturing, construction, and financial institutions, reinforcing the Bank’s role in supporting real economy sectors.

- Customer deposits reached AED 178 billion, up 15% year-on-year, driven by deepening client relationships and continued franchise strength. Notably, the CASA ratio rose to 69% of total deposits, providing a stable and low-cost funding base that enhances both profitability and liquidity resilience.

- Liquidity and Capital

Industry-leading capitalization and strong liquidity buffers reinforced by strong earnings underpin resilience and investor confidence in Mashreq’s credit strengthen.

- Mashreq maintained a robust liquidity position, with a Liquid Assets Ratio of 30.6%, a Loan-to-Deposit Ratio of 75%, and a Liquidity Coverage Ratio (LCR) of 120%—well above regulatory requirements—reinforcing the Bank’s conservative liquidity posture and capacity to navigate dynamic market conditions.

- The Bank’s capitalization profile remains among the strongest in the industry, supported by sustained profitability and prudent capital management. As of H1 2025, the Capital Adequacy Ratio (CAR) stood at 17.5%, with a Tier 1 Capital Ratio of 16.2% and a Common Equity Tier 1 (CET1) Ratio of 14.8%—providing a significant buffer above minimum regulatory thresholds and positioning the Bank to support growth while managing risk effectively.

- Mashreq further strengthened its funding base through a successful USD 500 million Sukuk issuance, deepening its access to international capital markets and reaffirming its leadership in Islamic finance. The issuance—priced at UST +105bps with a fixed profit rate of 5.03% per annum—was 6x oversubscribed despite market volatility, drawing interest from 90 global investors and reflecting deep confidence in Mashreq’s credit fundamentals and strategic direction.

- D-SIB Designation

Recognition of systemic importance reinforces Mashreq’s role as a cornerstone of the UAE financial system

- In H1 2025, the Central Bank of the UAE formally designated Mashreq as a Domestic Systemically Important Bank (D-SIB)—a testament to the Bank’s scale, financial strength, and critical role in the stability and advancement of the national banking ecosystem.

- This designation brings enhanced regulatory expectations, including elevated standards for stress testing, capital, liquidity, and risk governance. Mashreq is already well-positioned to meet and exceed these requirements, with a Capital Adequacy Ratio that surpasses fully-loaded D-SIB thresholds by a comfortable 25% margin as of June 30, 2025.

- The D-SIB status underscores the trust placed in Mashreq by regulators, clients, and stakeholders, and reinforces the Bank’s long-term strategic importance to the UAE’s economic transformation and financial resilience.

| AED 4.1 billion Net Profit Before Tax |

AED 6.2 billion Revenue |

AED 4.3 billion Operating Profit |

|||

| 21% YoY Loans & Advances Growth |

15% YoY Customer Deposits Growth (CASA 69%) |

30% Cost to Income Ratio |

|||

| 20% Return on Equity |

2.4% Return on Assets |

3.2% Net Interest Margin |

|||

| 17.5% Capital Adequacy Ratio |

1.2% NPL to Gross Loans Ratio |

210% NPL Coverage Ratio |

|||

H.E. Abdul Aziz Al Ghurair

Chairman, Mashreq

The first half of 2025 marked another period of exceptional performance and strategic momentum for Mashreq. Our results are a reflection of the trust our clients place in us, the strength and clarity of our long-term strategy, and our unwavering commitment to driving sustainable economic transformation across the UAE and the broader region.

While global macroeconomic uncertainty continues to pose challenges, the GCC stands out as a beacon of resilience, supported by strong policy frameworks, fiscal prudence, and a rapidly diversifying non-oil economy. This strength is clearly mirrored in the performance of the UAE banking sector, which saw total investments exceed AED 760 billion by March of this year.

Mashreq’s trajectory is firmly aligned with this regional momentum. Our continued ability to deliver double-digit growth, expand internationally, and lead with innovation underscores our differentiated value proposition and our disciplined execution across cycles. We remain resolute in our ambition to create enduring value by empowering clients, championing responsible finance, and building a digitally advanced, globally connected financial institution.

As the UAE economy maintains its upward trajectory, Mashreq will continue to be a key enabler—supporting inclusive growth, advancing national priorities, and reinforcing the country’s position as a global financial hub.

H.E. Abdul Aziz Al Ghurair

Chairman, Mashreq

The first half of 2025 marked another period of exceptional performance and strategic momentum for Mashreq. Our results are a reflection of the trust our clients place in us, the strength and clarity of our long-term strategy, and our unwavering commitment to driving sustainable economic transformation across the UAE and the broader region.

While global macroeconomic uncertainty continues to pose challenges, the GCC stands out as a beacon of resilience, supported by strong policy frameworks, fiscal prudence, and a rapidly diversifying non-oil economy. This strength is clearly mirrored in the performance of the UAE banking sector, which saw total investments exceed AED 760 billion by March of this year.

Mashreq’s trajectory is firmly aligned with this regional momentum. Our continued ability to deliver double-digit growth, expand internationally, and lead with innovation underscores our differentiated value proposition and our disciplined execution across cycles. We remain resolute in our ambition to create enduring value by empowering clients, championing responsible finance, and building a digitally advanced, globally connected financial institution.

As the UAE economy maintains its upward trajectory, Mashreq will continue to be a key enabler—supporting inclusive growth, advancing national priorities, and reinforcing the country’s position as a global financial hub.

Ahmed Abdelaal

Group Chief Executive Officer, Mashreq

Mashreq’s performance in the first half of 2025 reinforces the strength of our business model and our disciplined approach to sustainable, high-quality growth. Despite a more moderated rate environment and evolving global dynamics, we continued to deliver robust results—underpinned by strong client activity, a diversified earnings profile, and our unwavering commitment to innovation, efficiency, and value creation.

Our investment strategy remains sharply focused on future-proofing the organization. We are making measured yet impactful investments in upgrading our technology infrastructure, expanding our digital and international presence, and forming strategic partnerships that allow us to deliver best-in-class client experiences across all segments. These efforts are designed not just to enhance competitiveness but to embed long-term resilience and scalability into our operations.

At the same time, we have maintained strict cost discipline. Our ability to absorb continued investment—without compromising our industry-leading cost-to-income ratio of 30%—speaks to the strength of our operational model and our relentless focus on efficiency.

Our strategic expansion into high-growth markets such as Pakistan, Türkiye and Oman, along with our entry into GIFT City in India, marks a pivotal step in building Mashreq’s global relevance and connectivity. These initiatives are aligned with our ambition to support cross-border capital flows and to serve our clients across key economic corridors with tailored, high-impact financial solutions.

As we look ahead, our priorities remain clear: to scale responsibly, partner strategically, and invest intelligently—delivering long-term value to our shareholders while continuing to lead with innovation, discipline, and purpose.

Looking Ahead

Mashreq’s first-half performance in 2025 reaffirmed the strength of its diversified business model, the trust it commands across domestic and international markets, and its disciplined approach to strategic execution.

Looking ahead to the remainder of the year, the Bank will remain focused on driving innovation-led growth, enhancing customer experience across all segments, and expanding its presence in priority markets. Recent entries into Turkey and Oman mark the beginning of a broader regional expansion strategy, with Mashreq aiming to deepen its international footprint through a targeted, client-centric approach.

Supported by a strong capital and liquidity base, Mashreq is well-positioned to deliver sustainable and balanced growth, while preserving its leading asset quality and continuing to generate superior returns for shareholders.

Ahmed Abdelaal

Group Chief Executive Officer, Mashreq

Mashreq’s performance in the first half of 2025 reinforces the strength of our business model and our disciplined approach to sustainable, high-quality growth. Despite a more moderated rate environment and evolving global dynamics, we continued to deliver robust results—underpinned by strong client activity, a diversified earnings profile, and our unwavering commitment to innovation, efficiency, and value creation.

Our investment strategy remains sharply focused on future-proofing the organization. We are making measured yet impactful investments in upgrading our technology infrastructure, expanding our digital and international presence, and forming strategic partnerships that allow us to deliver best-in-class client experiences across all segments. These efforts are designed not just to enhance competitiveness but to embed long-term resilience and scalability into our operations.

At the same time, we have maintained strict cost discipline. Our ability to absorb continued investment—without compromising our industry-leading cost-to-income ratio of 30%—speaks to the strength of our operational model and our relentless focus on efficiency.

Our strategic expansion into high-growth markets such as Pakistan, Türkiye and Oman, along with our entry into GIFT City in India, marks a pivotal step in building Mashreq’s global relevance and connectivity. These initiatives are aligned with our ambition to support cross-border capital flows and to serve our clients across key economic corridors with tailored, high-impact financial solutions.

As we look ahead, our priorities remain clear: to scale responsibly, partner strategically, and invest intelligently—delivering long-term value to our shareholders while continuing to lead with innovation, discipline, and purpose.

Looking Ahead

Mashreq’s first-half performance in 2025 reaffirmed the strength of its diversified business model, the trust it commands across domestic and international markets, and its disciplined approach to strategic execution.

Looking ahead to the remainder of the year, the Bank will remain focused on driving innovation-led growth, enhancing customer experience across all segments, and expanding its presence in priority markets. Recent entries into Turkey and Oman mark the beginning of a broader regional expansion strategy, with Mashreq aiming to deepen its international footprint through a targeted, client-centric approach.

Supported by a strong capital and liquidity base, Mashreq is well-positioned to deliver sustainable and balanced growth, while preserving its leading asset quality and continuing to generate superior returns for shareholders.

Financial Review:

Note: Figures may not add up due to rounding differences

Note: Figures may not add up due to rounding differences

- Net Interest Income rose 1% quarter-on-quarter but declined 6% year-on-year due to a 61bps contraction in NIM to 3.2%, which was driven by a 100bps rate cut by UAE Central Bank.

- Non-Interest Income representing 36% of Total Operating Income witnessed a 17% year-on-year growth in H1 2025 to AED 2.2 billion supported by strong growth in investment (+55% year-on-year) and other income (+56% year-on-year).

- Total Operating Income increased by 1% to AED 6.2 billion in H1 2025 supported by non-interest income and double-digit growth in the loan and advances.

- Operating expenses grew by 11.5%, reflecting continued investment in digital innovation and strategic business expansion.

- Impairment allowances remained low at AED 245 million in H1 2025 (cost of credit of 36bps), reflecting the strong quality of the loan book and underwriting standards.

- Income tax expense of AED 604 million in H1 2025 up by 35% year-on-year impacted the net profit after tax, which saw a decline of 14% to reach AED 3.5 billion in H1 2025, with a strong ROE of 20%.

Note: Figures may not add up due to rounding differences

Note: Figures may not add up due to rounding differences

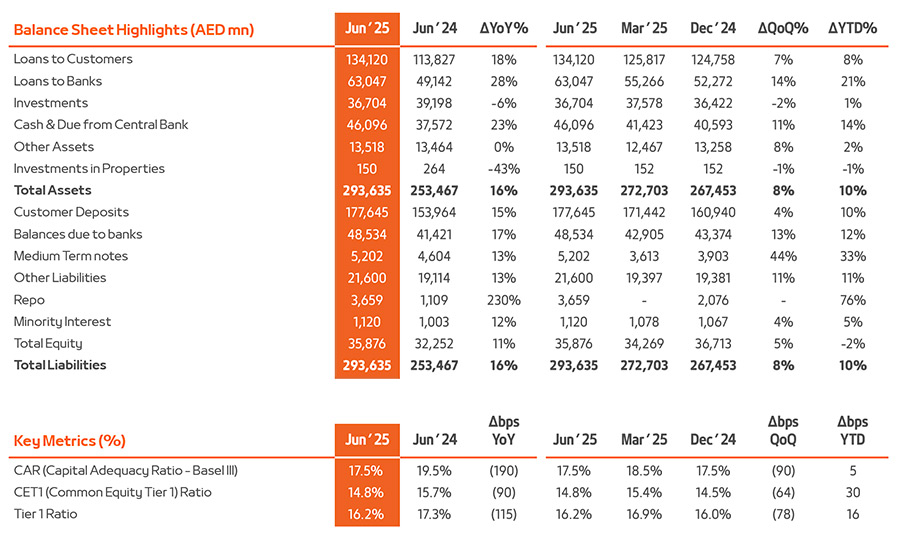

- Total Assets grew to AED 294 billion in H1 2025, marking a 16% year-on-year and 10% year-to-date increase, due to continued credit growth and liquidity optimization

- The growth in the balance sheet is supported by year-on-year growth in total assets of wholesale banking segment by 23% to AED 161 billion and retail banking segment by 12% to AED 35 billion

- Customer Deposits increased 15% year-on-year to AED 177 billion with CASA accounting for 69% of total deposits

- NPL Ratio stood at 1.2% and remained the lowest in the industry

- Strong capitalization in H1 2025 with Capital Adequacy Ratio of 17.5%, CET1 ratio of 14.8% and Tier 1 ratio of 16.2%, however slightly impacted by strong credit growth resulting in increased Risk Weighted Assets

UAE

Financials