Dubai, UAE: Mashreq Bank PSC (MASQ) reported its financial results for Q1 2025.

Mashreq continues to deliver market-leading returns, supported by best-in-class asset quality and a robust capital structure. The bank’s first quarter of 2025 results underscores the strength and resilience of Mashreq’s diversified business model, even in a softer interest rate environment.

Key Highlights:

- Revenues

Mashreq delivered AED 3.1 billion in operating income, reflecting its resilience and strategic focus, as the Bank continued to seize market opportunities and drive performance.

- Mashreq's client asset growth combined with healthy client margins helped cushion the impact of the 100bps reduction in the UAE Central Bank’s benchmark interest rate, limiting year-on-year Net Interest Margin (NIM) compression to just 62bps and remaining a strong NIM at 3.3%

- Non-interest income increased by 16% year-on-year, underscoring the effectiveness of the bank’s strategy to diversify revenue streams beyond traditional interest-based income, reducing total revenue exposure to interest rate fluctuations.

- Net Profit

Mashreq delivered a solid quarterly Profit Before Tax of AED 2.1 billion, driven by strong balance sheet growth, including a 14% year-on-year increase in loans and advances and a 10% year-on-year rise in customer deposits, double digit growth in non-interest income, controlled expense growth and relative low risk costs.

- Return on Equity (ROE) of 21% reflects strong profitability and effective capital deployment, underscoring the banks disciplined execution of its growth and digital strategies and underlying its financial strength.

- Expenses

Ongoing strategic investments in digital transformation and international expansion led to marginal increase in operating expenses

- Operating expenses increased by 9.5% year-on-year while Cost-to-Income Ratio stood at 29% compared to 27% in Q1 2024 and 30%(1) in full-year 2024.

- Asset Quality

Mashreq continues to set the standard for asset quality, with the Non-Performing Loan ratio improving to 1.3% from 1.4% year-on-year — a clear reflection of the Bank’s disciplined risk management and proactive credit oversight.

- Despite double digit growth in loans and advances, the provision charges have remained low at AED 101 million driven by robust asset quality of the lending book and disciplined credit risk management

- The Non-Performing Loans to Gross Loans (NPL) stood at just 1.3%, reaffirming Mashreq’s position among the best in class for asset quality

- The Coverage Ratio remained strong at 204%, underlining the bank’s prudent provisioning strategy and its capacity to navigate evolving credit conditions

- Balance Sheet

First quarter 2025 marked a period of strong balance sheet expansion, driven by continued growth across Mashreq’s UAE and international franchises

- Loans and advances — including to customers and banks — grew by a strong 14% year-on-year, driven by healthy expansion in customer deposits. This reflects growing demand across key segments and highlights the Bank’s continued momentum in delivering disciplined, well-funded growth

- Total assets rose by 9% to reach AED 273 billion, reflecting the Bank’s continued focus on sustainable growth, strong client activity, and effective deployment of capital across core markets

- Customer deposits reached AED 171 billion, underpinned by continued client trust and engagement. Notably, Current and Savings Accounts (CASA) made up 65% of total deposits, further strengthening the Bank’s low-cost funding base and reflecting the depth of its retail and corporate franchise across core markets

- Liquidity and Capital

Mashreq continues to demonstrate a resilient capital and liquidity foundation, driven by consistent internal capital generation and rigorous, forward-looking risk management strategy.

- The Bank reported a Liquid Assets Ratio of 32.5% and a Liquidity Coverage Ratio (LCR) of 126%, comfortably above the regulatory minimum of 100%, reflecting its prudent liquidity stance.

- Capitalization metrics continued to strengthen, driven by solid profitability with Capital Adequacy Ratio (CAR): 18.5%, Tier 1 Capital Ratio: 17.0% and Common Equity Tier 1 (CET1) Ratio: 15.4%

- These capital levels underscore Mashreq’s sound capital management strategy and its ability to support sustainable growth and execute on its long-term strategic priorities.

| AED 2.1 billion Net Profit Before Tax (AED 1.8 Billion NPAT) |

AED 3.1 billion Revenue |

AED 2.2 billion Operating Profit |

|||

| 14% YoY Loans & Advances Growth |

10% YoY Customer Deposits Growth (CASA 65%) |

29% Cost to Income Ratio |

|||

| 21% Return on Equity |

2.5% Return on Assets |

3.3% Net Interest Margin |

|||

| 18.5% Capital Adequacy Ratio |

1.3% NPL to Gross Loans Ratio |

||||

H.E. Abdul Aziz Al Ghurair

Chairman, Mashreq

The beginning of 2025 marks another chapter in Mashreq’s journey of innovation, resilience and regional leadership. As the UAE and the broader GCC region continue to accelerate their digital and economic transformation, Mashreq remains deeply aligned with these national priorities. We are expanding our reach, advancing our capabilities and enabling inclusive growth across markets.

While ongoing geopolitical uncertainties and trade tensions continue to test global economic confidence, their direct impact on the GCC has remained limited thanks to strategic oil exemptions and the region’s prudent macroeconomic policies. The banking sector across the UAE and wider GCC continues to demonstrate resilience and adaptability, supported by sound regulation, digital innovation and diversification-led growth. Mashreq’s own trajectory mirrors this momentum.

We remain steadfast in our ambition to contribute to the UAE’s evolution as a global financial hub while supporting the wider region in building a diversified and future-ready economy. Our role is to act as an enabler of this progress by empowering clients through technology, pioneering sustainable finance and investing in digital infrastructure that will define the future of banking.

H.E. Abdul Aziz Al Ghurair

Chairman, Mashreq

The beginning of 2025 marks another chapter in Mashreq’s journey of innovation, resilience and regional leadership. As the UAE and the broader GCC region continue to accelerate their digital and economic transformation, Mashreq remains deeply aligned with these national priorities. We are expanding our reach, advancing our capabilities and enabling inclusive growth across markets.

While ongoing geopolitical uncertainties and trade tensions continue to test global economic confidence, their direct impact on the GCC has remained limited thanks to strategic oil exemptions and the region’s prudent macroeconomic policies. The banking sector across the UAE and wider GCC continues to demonstrate resilience and adaptability, supported by sound regulation, digital innovation and diversification-led growth. Mashreq’s own trajectory mirrors this momentum.

We remain steadfast in our ambition to contribute to the UAE’s evolution as a global financial hub while supporting the wider region in building a diversified and future-ready economy. Our role is to act as an enabler of this progress by empowering clients through technology, pioneering sustainable finance and investing in digital infrastructure that will define the future of banking.

Ahmed Abdelaal

Group Chief Executive Officer, Mashreq

Mashreq entered 2025 with strong momentum, delivering over AED 3 billion of operating income in the first quarter and achieving 14 percent year-on-year growth in loans and advances. These results reflect the continued strength of our diversified business model and our disciplined execution, even amid a more measured interest rate environment.

We advanced several strategic priorities during the quarter, including the launch of Mashreq Oman and the successful pilot of digital retail banking in Pakistan. We also continued to strengthen our presence across key markets in MENA and Egypt, aligning our expansion strategy with client demand for more connected, innovative banking solutions.

We introduced Mashreq Biz to empower SMEs, expanded our partnership with Mastercard to Pakistan, and launched a collaboration between NEOBIZ and NEOPAY to enhance digital access for entrepreneurs. These initiatives underscore our commitment to financial inclusion, innovation, and scalable growth.

Our NEO platform continues to gain momentum across international markets, and we became the first bank in the region to obtain external assurance for our full ESG data set. This milestone affirms our leadership in responsible banking and reflects the trust placed in us by clients and regulators alike.

Looking ahead, we remain focused on scaling our Banking-as-a-Service model, deepening embedded finance capabilities, and accelerating the deployment of AI-driven solutions to deliver seamless, hyper-personalized client experiences across every touchpoint. Enhancing the customer experience is central to our strategy, ensuring that our products, platforms, and people work together to meet evolving expectations.

As we shape the next chapter of our journey, Mashreq will continue to lead with agility and purpose, building a future-ready bank that redefines the financial landscape across our core markets and beyond.

Looking Ahead

Mashreq delivered a solid and stable performance in Q1 2025, reflecting the strength of its diversified business model and disciplined execution. The Bank remains focused on driving forward its strategic priorities for 2025 — with innovation, regional growth, and an enhanced client experience at the core.

With a strong foundation and a forward-looking approach, Mashreq is accelerating its ambition to be a digital banking leader in the region. The continued rollout of its Banking-as-a-Service strategy is reshaping how financial services are delivered — creating scalable, seamless solutions that meet the evolving needs of clients across markets.

Ahmed Abdelaal

Group Chief Executive Officer, Mashreq

Mashreq entered 2025 with strong momentum, delivering over AED 3 billion of operating income in the first quarter and achieving 14 percent year-on-year growth in loans and advances. These results reflect the continued strength of our diversified business model and our disciplined execution, even amid a more measured interest rate environment.

We advanced several strategic priorities during the quarter, including the launch of Mashreq Oman and the successful pilot of digital retail banking in Pakistan. We also continued to strengthen our presence across key markets in MENA and Egypt, aligning our expansion strategy with client demand for more connected, innovative banking solutions.

We introduced Mashreq Biz to empower SMEs, expanded our partnership with Mastercard to Pakistan, and launched a collaboration between NEOBIZ and NEOPAY to enhance digital access for entrepreneurs. These initiatives underscore our commitment to financial inclusion, innovation, and scalable growth.

Our NEO platform continues to gain momentum across international markets, and we became the first bank in the region to obtain external assurance for our full ESG data set. This milestone affirms our leadership in responsible banking and reflects the trust placed in us by clients and regulators alike.

Looking ahead, we remain focused on scaling our Banking-as-a-Service model, deepening embedded finance capabilities, and accelerating the deployment of AI-driven solutions to deliver seamless, hyper-personalized client experiences across every touchpoint. Enhancing the customer experience is central to our strategy, ensuring that our products, platforms, and people work together to meet evolving expectations.

As we shape the next chapter of our journey, Mashreq will continue to lead with agility and purpose, building a future-ready bank that redefines the financial landscape across our core markets and beyond.

Looking Ahead

Mashreq delivered a solid and stable performance in Q1 2025, reflecting the strength of its diversified business model and disciplined execution. The Bank remains focused on driving forward its strategic priorities for 2025 — with innovation, regional growth, and an enhanced client experience at the core.

With a strong foundation and a forward-looking approach, Mashreq is accelerating its ambition to be a digital banking leader in the region. The continued rollout of its Banking-as-a-Service strategy is reshaping how financial services are delivered — creating scalable, seamless solutions that meet the evolving needs of clients across markets.

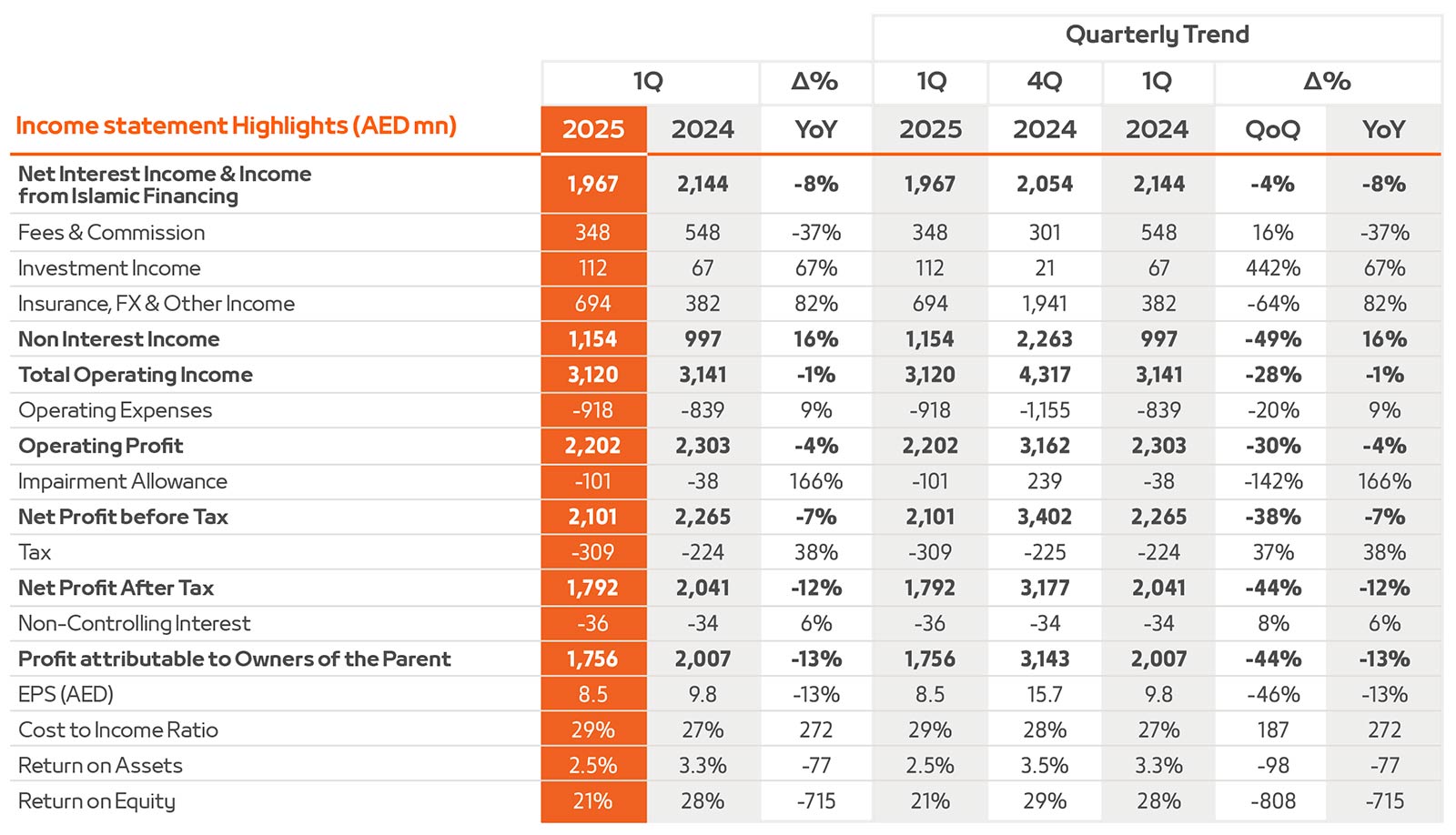

Financial Review:

Note: Figures may not add up due to rounding differences

(1) 30.3% excluding the one-off gain from partial sale of a subsidiary

Note: Figures may not add up due to rounding differences

(1) 30.3% excluding the one-off gain from partial sale of a subsidiary

- Net Interest Income declined by 8% year-on-year due to a 62bps contraction in NIM to 3.3%, which was driven by a 100bps rate cut by UAE Central Bank

- Non-Interest Income representing 37% of Total Operating Income witnessed a 16% year-on-year growth in Q1 2025 to AED 1.1 billion. Mashreq’s strategic presence across the key trade corridors enables it to drive higher trade and Fx income, resulting in strong improvement in non-interest income

- Total Operating Income remained flat at AED 3 billion in Q1 2025 supported by robust non-interest income and growth in the loan and advances

- Operating expenses grew by 9% reflecting continued investment in digital innovation and strategic business expansion – initiatives focused on boosting operational efficiency and reinforcing the Bank’s regional and international footprint.

- Impairment allowances remained low at AED 101 million in Q1 2025, reflecting the solid fundamentals of the Bank’s lending book and disciplined credit practices.

- Income tax expense of AED 309 million — up 38% quarter-on-quarter — reflecting the impact of the new BEPS Pillar 2 Global Minimum Top-up Tax. Despite this, net profit after tax reached AED 1.8 billion, with a strong ROE of 21%.

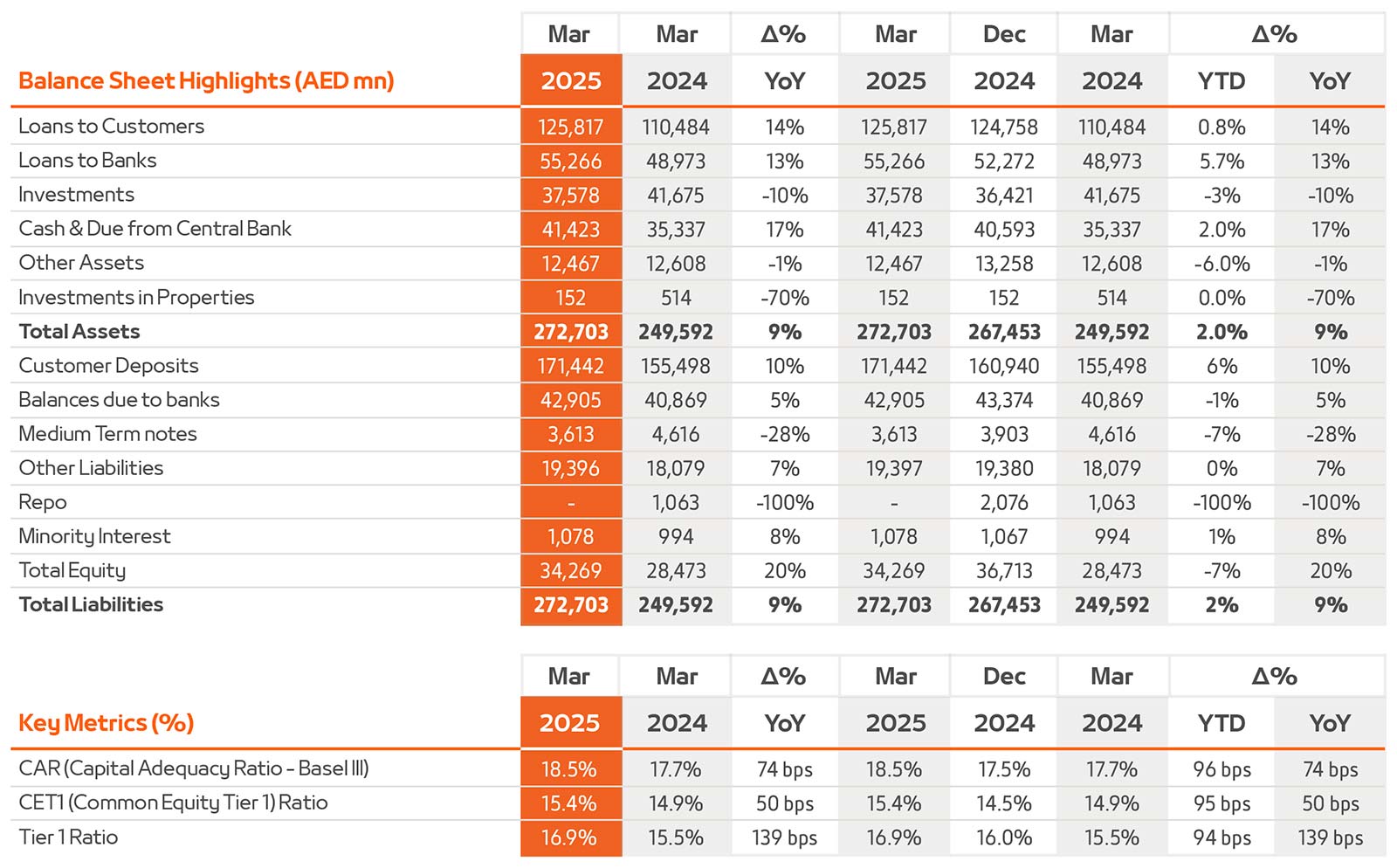

Note: Figures may not add up due to rounding differences

Note: Figures may not add up due to rounding differences

- Total Assets grew to AED 273 billion in Q1 2025, marking a 9% year-on-year and 2% quarter-on-quarter increase, fueled by sustained growth in loans and advances and the Bank’s strategic focus on scaling its core business

- The growth in the balance sheet is supported by year-on-year growth in total assets of wholesale banking segment by 16.9% to AED 148 billion and retail banking segment by 9% to AED 33 billion

- Customer Deposits increased 10% year-on-year to AED 171 billion with CASA accounting for 65% of total deposits

- NPL Ratio stood at 1.3% and remained the lowest in the industry

- Strong capitalization in Q1 2025 with Capital Adequacy Ratio of 18.5%, CET1 ratio of 15.4% and Tier 1 ratio of 16.9%, a 74bps, 50bps and 139bps improvement year-on-year, respectively

1Q 2025 Awards:

Click Here Download PDFUAE

Financials